How Do I Figure Sales Tax on a Calculator?

As a consumer or a business owner, understanding how to accurately calculate sales tax is essential. Not only does it help ensure compliance with tax laws, but it also enables one to make informed financial decisions. In this article, I will guide you through the process of calculating sales tax using a calculator, equipped with clear examples and practical tips.

Understanding Sales Tax

Sales tax is a percentage of the sale price of goods or services, typically imposed by state and local governments. The rate can vary significantly based on your location, the type of product or service, and whether the transaction is exempt from tax.

The Basic Formula

The formula to calculate sales tax is relatively straightforward:

[ \textSales Tax = \textSale Price \times \textSales Tax Rate ]

Therefore, the total amount payable, including sales tax, can be expressed as:

[ \textTotal Price = \textSale Price + \textSales Tax ]

Step-by-Step Instructions Using a Calculator

- Identify the sale price of the item or service you want to purchase or sell.

- Determine the sales tax rate applicable in your jurisdiction (this rate is often expressed as a percentage).

- Convert the sales tax rate from a percentage to a decimal. For instance, if the tax rate is 7%, divide by 100 to get 0.07.

- Multiply the sale price by the decimal sales tax rate using your calculator.

- Add the sales tax to the original sale price to find the total amount due.

Example Calculation

Sale Price: $50.00

Sales Tax Rate: 7%

- Convert percentage: 7% = 0.07

- Calculate sales tax: [ $50.00 \times 0.07 = $3.50 ]

- Calculate total price: [ $50.00 + $3.50 = $53.50 ]

Thus, the total amount payable is $53.50.

Utilizing a Table for Different Sales Tax Rates

For ease of understanding, I will provide a breakdown of how sales tax affects different sale prices at a tax rate of 7%. This is helpful, as you can see how sales tax varies according to the sale price:

Sale Price

Sales Tax (7%)

Total Price

$10.00

$0.70

$10.70

$25.00

$1.75

$26.75

$50.00

$3.50

$53.50

$100.00

$7.00

$107.00

$250.00

$17.50

$267.50

$500.00

$35.00

$535.00

$1,000.00

$70.00

$1,070.00

This table illustrates the sales tax and total price for various sale amounts, making it easier to estimate costs without calculating from scratch each time.

Additional Considerations

As I navigate these calculations, several factors and situations can complicate matters when it comes to sales tax:

- Exemptions: Certain items may be exempt from sales tax depending on local laws (e.g., groceries or prescription medications in some areas).

- Multiple Rates: Some jurisdictions have multiple sales tax rates (e.g., state, county, and city taxes) which can apply simultaneously.

- Online Purchases: If you're shopping online, be mindful that the applicable tax rate may differ based on the seller's location and your shipping address.

Common Sales Tax Questions

What is the typical sales tax rate?

- Sales tax rates vary widely across the United States, typically ranging from 0% to over 10%. Research your specific area for accurate data.

Do I need to calculate sales tax for services?

- This depends on local laws; some services may be taxable while others are not.

How do I establish if an item is tax-exempt?

- Check with your state’s tax authority. Often, items like groceries or educational materials have clear guidelines regarding exemptions.

What if I’m calculating sales tax for international purchases?

- International sales tax laws differ substantially; always consult local regulations to understand if and how sales tax applies.

Conclusion

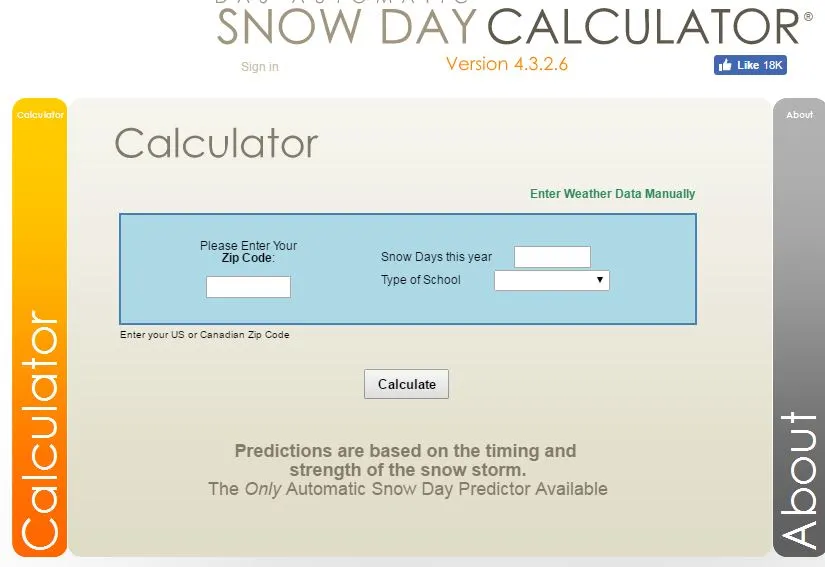

Calculating sales tax on a calculator is a straightforward task that ensures you are equipped with the necessary details for financial transactions. By understanding snow day calculator and having a handy sales tax table, you can navigate these calculations proficiently. Always stay informed about the sales tax rates and rules in your area to ensure compliance and to make informed spending decisions.

“The way to gain a good reputation is to endeavor to be what you desire to appear.” — Socrates

Whether you are an individual shopper or a business owner, mastering the calculation of sales tax is a vital step toward financial savvy and responsibility.

Final Thoughts

As someone who values understanding the intricacies of financial transactions, I encourage you to keep records of your transactions and continuously educate yourself about changes in sales tax laws. Should you have any further questions or topics you want to explore regarding sales tax calculation, feel free to reach out!